Can You Sell An Option Without Owning The Stock

Trade the covered call without the stock. If the stock were to rise above the strike price of 50 at the time of option expiration the stock could be.

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png) Naked Call Writing A High Risk Options Strategy

Naked Call Writing A High Risk Options Strategy

can you sell an option without owning the stock

can you sell an option without owning the stock is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you sell an option without owning the stock content depends on the source site. We hope you do not use it for commercial purposes.

You can sell anything you bought.

Can you sell an option without owning the stock. If they can find the stock to perform the assignment they are taking a risk with the opening price of the stock once trading resumes. But if you own a stock and buy a put option on the same stock a covered put youre protecting your position and limiting your downside risk for the life of the put option. Based on your trading experience and account parameters set by the brokerage you can buy options without owning the underlying stock.

Long story short without owning the stock you can be screwed. Buy the stock and sell. If the equity rises significantly in price the trader can lose a lot of money when selling call options without owning stock.

Buying a put option without owning the stock is called buying a naked put. When you short in the spot market you obviously sell first. Call contracts in options trading.

That having been said sellers of options tend to make more money than buyers of options over the long term. If the equity rises significantly in price the trader can lose a lot of money when selling call options without owning stock. The exchange does not differentiate between a regular selling of stock f.

From the point of view of the brokers there are also issues they have to contend with. A call option is a financial contract between two parties. Naked puts give you the potential for profit if the underlying stock falls.

Selling options before buying them require either the underlying stock or significant margin intended to protect the brokerage and market should the position go against you. The moment you sell a stock the backend process would alert the exchange that you have sold a particular stock. That having been said sellers of options tend to make more money than.

Can You Sell Options Without Owning At Least 100 Shares Of Stock Episode 287

Can You Sell Options Without Owning At Least 100 Shares Of Stock Episode 287

Selling Call Options Without Owning Stock

Selling Call Options Without Owning Stock

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png) Naked Call Writing A High Risk Options Strategy

Naked Call Writing A High Risk Options Strategy

Selling Call Options Without Owning Stock

Selling Call Options Without Owning Stock

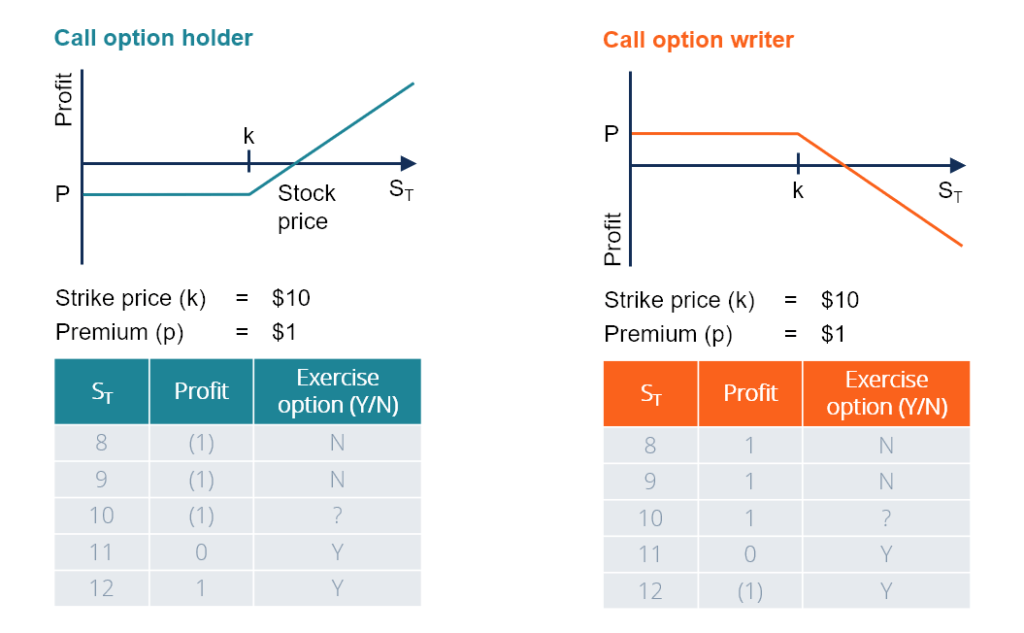

Call Option Understand How Buying Selling Call Options Works

Call Option Understand How Buying Selling Call Options Works

Selling Put Options Tutorial Examples

Selling Put Options Tutorial Examples

How To Sell Calls And Puts Fidelity

How To Sell Calls And Puts Fidelity

What Is A Put Option The Motley Fool

What Is A Put Option The Motley Fool

/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png) Beginner S Guide To Call Buying

Beginner S Guide To Call Buying

What Is A Put Option Examples And How To Trade Them In 2019

What Is A Put Option Examples And How To Trade Them In 2019

Selling Call Options Without Owning Stock

Selling Call Options Without Owning Stock