Can I Buy A Stock On The Ex Dividend Date

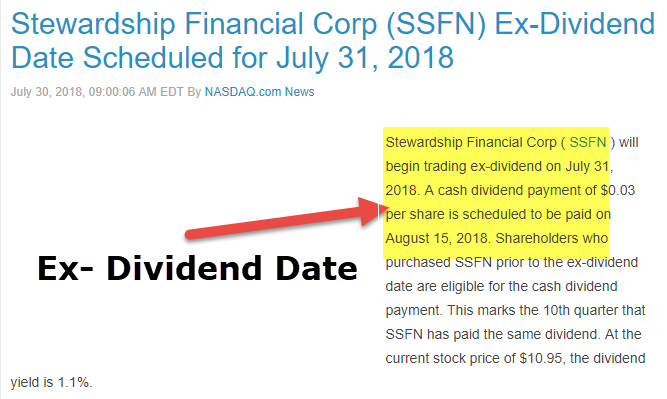

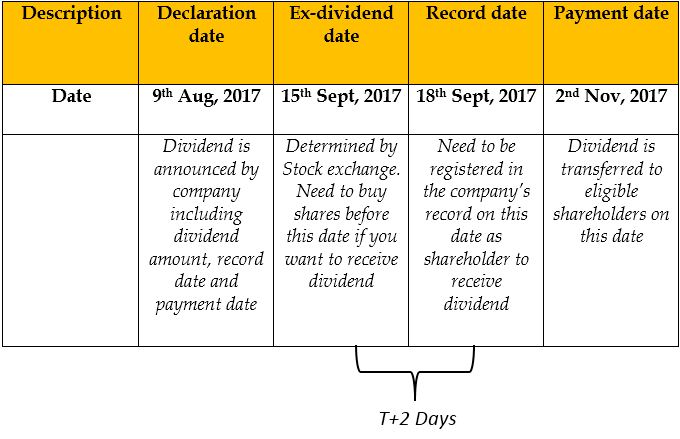

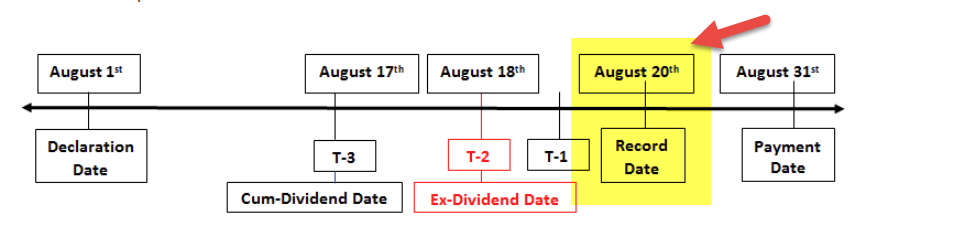

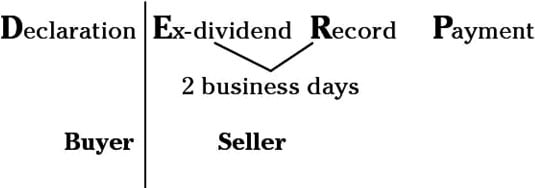

Once the company sets the record date the ex dividend date is set based on stock exchange. Ex dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller.

can i buy a stock on the ex dividend date

can i buy a stock on the ex dividend date is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i buy a stock on the ex dividend date content depends on the source site. We hope you do not use it for commercial purposes.

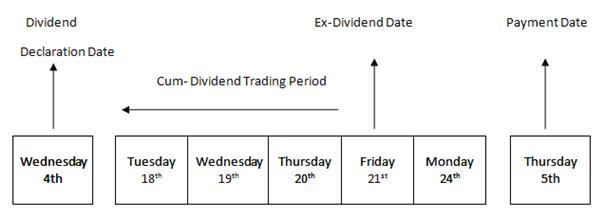

The day count is important so that the investor clearly owns the stock on the ex dividend date.

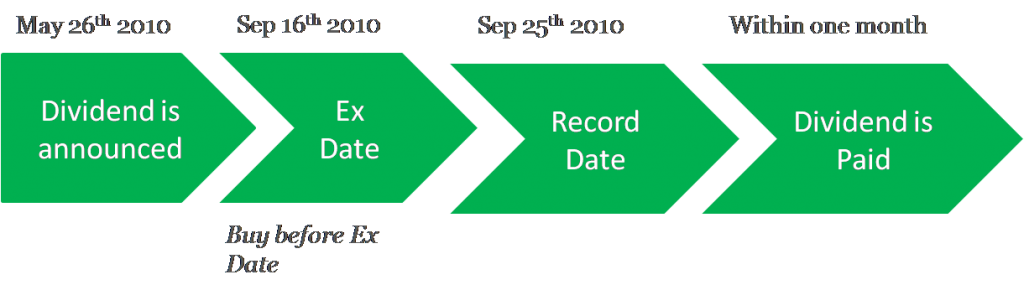

Can i buy a stock on the ex dividend date. That means that the stock must be purchased no later than the day of record. Investors can use the ex dividend date search tool to track stocks that are going ex dividend during a specific date range. Dividend investors seeking to optimize income from their investments should look at ex dividend.

Me also not an advocate of dividend harvesting. To ensure the receipt of a pending dividend from a stock you own the ex dividend date is the most important of the three to understand. So if you buy stock the day after ex date you will not earn a dividend until three months later.

Remember that you. You dont get a dividend if you buy a stock that the day the dividend is paid. In the above example the ex dividend date for a stock thats paying a dividend equal to 25 or more of its value is october 4 2017.

If your investing strategy is focused on income knowing when the ex date. The stock dividend may be additional shares in the company or in a subsidiary being spun off. Why dont investors buy stock just before the dividend date and sell right.

Sometimes a company pays a dividend in the form of stock rather than cash. Rather you have to understand the difference between the ex dividend date the record date and the payment date. Ex dividend dates are extremely important in dividend investing because you must own a stock before its ex dividend date in order to be eligible to receive its next dividend.

On or after the ex dividend date. Buying stock before the ex dividend date is easy as long as basic rules are followed. For example if a company has declared a dividend of 220 per share every 100 shares earns 220 per year or 55 per quarter.

Investors need to buy a dividend paying stock at least one day before the record date since trades take a day to settle. When a company declares a dividend it sets a record date when you must be on the companys books as a shareholder to receive the dividend. This brings up an interesting timing strategy that even value investors can employ.

How to buy stock before ex dividend date. To a buy. The ex dividend date is typically set for two business days prior to the record date.

You must buy the stock before the ex dividend date in order to be a stockholder of record and thus be. Companies also use this date to determine who is sent proxy statements financial reports and other information.

Someone Told Me If I Purchase The Stock Shares Before Ex

Someone Told Me If I Purchase The Stock Shares Before Ex

Ex Dividend Date Of Stocks Examples Chronology Of

Ex Dividend Date Of Stocks Examples Chronology Of

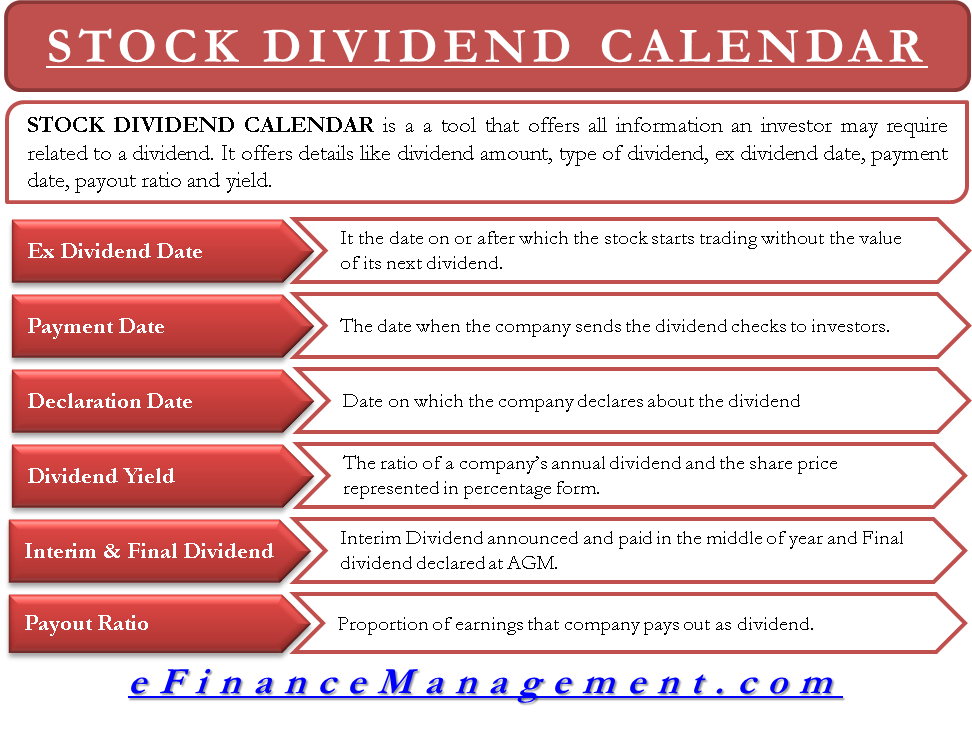

Ex Dividend Date Efinancemanagement Com

Ex Dividend Date Efinancemanagement Com

An In Depth Guide To How Dividend Stocks Work Trade

An In Depth Guide To How Dividend Stocks Work Trade

Ex Dividend Date Calendar Dividend Ladder

Comparing Ex Dividend Date Vs Date Of Record

Date Of Record For Dividends Record Date Vs Ex Dividend Date

Date Of Record For Dividends Record Date Vs Ex Dividend Date

What You Should Know About Dividend Dates For The Series 7

What You Should Know About Dividend Dates For The Series 7

Ex Dividend Date Stock Trading Stock Trading Teacher

Ex Dividend Date Stock Trading Stock Trading Teacher

When Am I Eligible To Receive A Dividend

When Am I Eligible To Receive A Dividend

:max_bytes(150000):strip_icc()/Clipboard01-1928dde9715243c8acb7abc8c3ad1c6b.jpg)