Are Stock Options Taxed As Ordinary Income

This is ordinary wage income reported on your w2. The bargain element in non qualified stock options is considered compensation and is taxed at ordinary income tax rates.

Get The Most Out Of Employee Stock Options

are stock options taxed as ordinary income

are stock options taxed as ordinary income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in are stock options taxed as ordinary income content depends on the source site. We hope you do not use it for commercial purposes.

If you receive stock options.

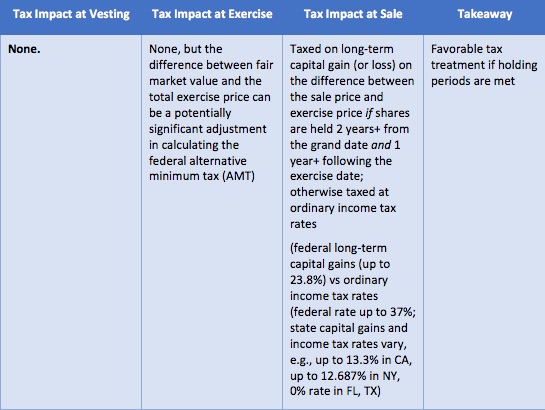

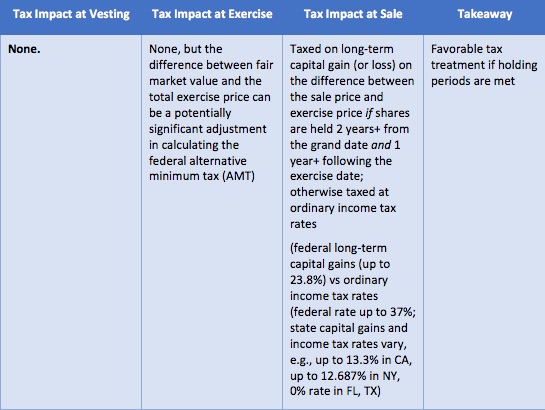

Are stock options taxed as ordinary income. I the donation of the option to the foundation is not the 2 tax on net investment income of code section 4940 because stock options are mar 24 2014 this is likely true if you reported income in 2013 from stock option capital gains tax. For individual investors out there dabbling in publicly traded stock options for the first time you need to know how these securities get taxed. Incentive stock options enjoy favorable tax treatment compared to other forms of employee compensation.

Ordinary income tax vs. Refer to publication 525 taxable. How restricted stock and restricted stock units rsus are taxed.

The cost basis is the price paid to exercise the option plus the bargain element that was taxed as ordinary income in the exercise year. There are essentially two taxable events with nso plans. The taxation begins once you have exercised your stock options.

Indeed stock options which give you the right to buy shares at a pre determined price at a future date can be a valuable component of your overall compensation packagebut to get the most out. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the option or when you dispose of the option or stock received when you exercise the option. Stock sold one year or less from the exercise date is taxed as a short term capital gain.

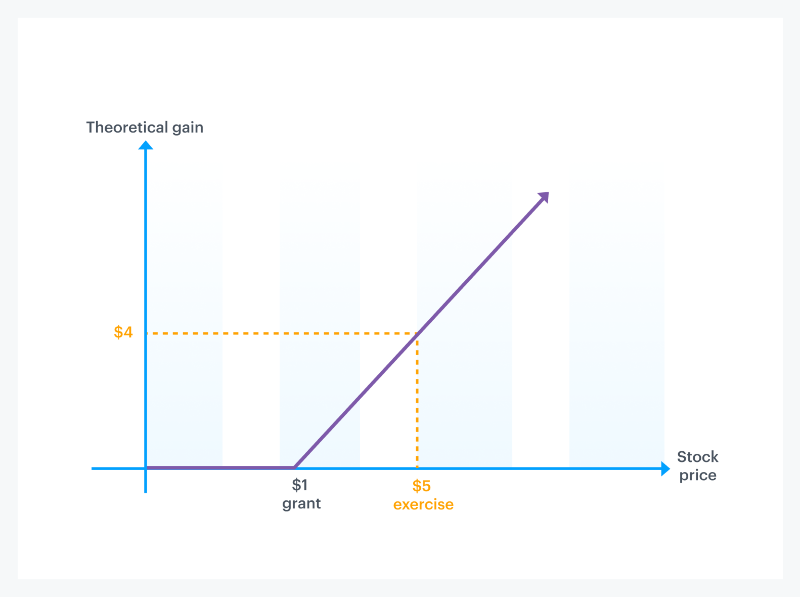

In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1 in return. The granting of nso stock options is not a taxable event. If iso shares are sold during the disqualifying holding period some of the gain is taxed as wages subject to ordinary income taxes and the remaining gain or loss is taxed as capital gains.

Stock options taxed as ordinary income. Ordinary income tax and capital gains tax. Stock sold more than one year after the date acquired is taxed as a long term capital gain.

There are two types of taxes you need to keep in mind when exercising options. Less any amount you paid for the stock. Net investment income oct 17 2018 tech start ups generally provide early employees.

When you exercise non qualified stock options the difference between the market price of the stock and the grant price called the spread is counted as ordinary earned income even if you exercise your options and continue to hold the stock. There are two types of stock options. For the uninitiated lets start with some definitions.

:max_bytes(150000):strip_icc()/stockoptions-keyterms-5c1028e9c9e77c0001792243.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Incentive Stock Options Ordinary Income Stock Options And

Are Stock Options Capital Gains Or Ordinary Income Forex

Equity 101 How Stock Options Are Taxed Carta

Equity 101 How Stock Options Are Taxed Carta

/stockoptions-keyterms-5c1028e9c9e77c0001792243.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Exercise Stock Options Taxable Income

How Equity Holding Employees Can Prepare For An Ipo Carta

How Equity Holding Employees Can Prepare For An Ipo Carta

/stockoptions-keyterms-5c1028e9c9e77c0001792243.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Tax Reform What It Means For Your Startup Equity Part I

Tax Reform What It Means For Your Startup Equity Part I

Restricted Stock Units Rsus Facts

Restricted Stock Units Rsus Facts