Cash Isa And Stocks And Shares Isa In Same Year

Or split it another way. They are a few different types of isa.

The Complete Beginner S Guide To Cash Isas All You Need To Know

The Complete Beginner S Guide To Cash Isas All You Need To Know

cash isa and stocks and shares isa in same year

cash isa and stocks and shares isa in same year is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in cash isa and stocks and shares isa in same year content depends on the source site. We hope you do not use it for commercial purposes.

Cash stocks and shares innovative finance lifetime and.

Cash isa and stocks and shares isa in same year. The first is a stocks shares isaeveryone aged 18 and above can put up to 20000 into a stocks shares isa for the 201718 and 2018. An isa is a wrapper that can be used to help save you tax. Britons can open one of each type of isa in each tax year.

This is known as the isa allowance. If you dont understand a financial product get independent financial. Split the allowance between cash stocks shares lifetime or innovative finance isas.

If you wanted to you could invest 5000 in a cash isa 10000 in a stocks shares isa and 5000 in an innovative finance isa. And once the tax year ends you arent limited to just using the same providers. You get to choose.

The total amount you can save in isas in the current tax year is 20000. There are four types of isa cash isas stocks and shares isas innovative finance isas and lifetime isas. How does this work.

This article looks at stocks and shares isas. You can have a cash isa with a bank and also pay into a stocks shares isa with a stockbroker. When paying into multiple types of isa in a tax year they dont all have to be with the same provider.

You can hold one lifetime isa alongside other cash stocks and shares or innovative finance isas all within your annual isa allowance of 20000. Stocks shares isa. Each person is allowed to open one of each type of isa each tax year with a minimum age of 18 for all isas except the cash isa where the minimum age is 16.

Yes you can contribute to both a regular stocks and shares isa and a stocks and shares lifetime isa in the same tax year. First lets tackle the bread and butter stuff.

Individual Savings Accounts B 2013 14

Individual Savings Accounts B 2013 14

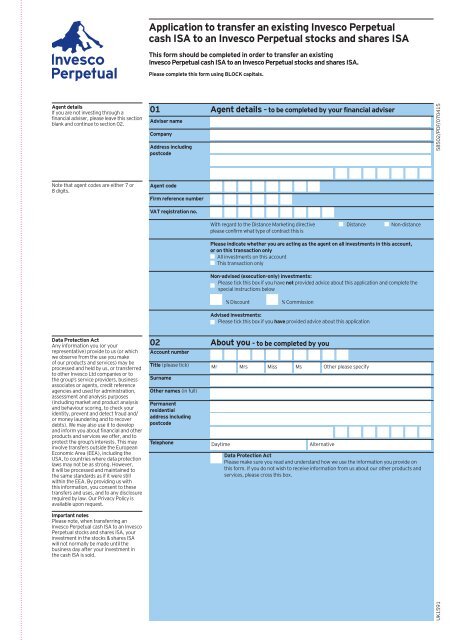

Application To Transfer An Existing Invesco Perpetual Cash

Application To Transfer An Existing Invesco Perpetual Cash

Stocks Shares Isa Application Pdf Free Download

Stocks Shares Isa Application Pdf Free Download

Stocks Shares Isa Application Pdf Free Download

Stocks Shares Isa Application Pdf Free Download

Swindon Issue 31 By 50 Plus Magazine Issuu

Swindon Issue 31 By 50 Plus Magazine Issuu

The Motley Fool Uk Here S Why A Cash Isa Is Pants Compared

The Motley Fool Uk Here S Why A Cash Isa Is Pants Compared

Ask An Expert How Many Isas Can I Have

Ask An Expert How Many Isas Can I Have

Fillable Online Icvc And Isa Application Forms 2016 2017

Fillable Online Icvc And Isa Application Forms 2016 2017

Cash Isas Vs Stocks Shares Isas Which Is Best For You

Cash Isas Vs Stocks Shares Isas Which Is Best For You

Ratesetter Isa Milestone Passes 250 Million In Subscriptions

Ratesetter Isa Milestone Passes 250 Million In Subscriptions