Dividends On Preferred And Common Stock Example

Preferred stock is sold at a par value and paid a regular dividend that. What does preferred dividends mean.

Preferred Dividend Definition Formula How To Calculate

Preferred Dividend Definition Formula How To Calculate

dividends on preferred and common stock example

dividends on preferred and common stock example is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in dividends on preferred and common stock example content depends on the source site. We hope you do not use it for commercial purposes.

Most preferred shares are also callable meaning the issuer can redeem the shares at any time so they provide investors with more options than common sharesbut for all of these advantages preferred stock has.

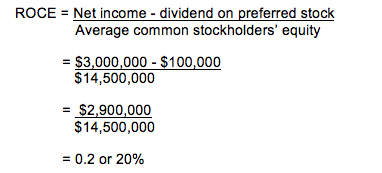

Dividends on preferred and common stock example. Preferred stock also gets priority over common stock so if a company misses a dividend payment it must. In this video we examine how to allocated dividends that have been declared between preferred and common shares of stock. The presence of preferred stock.

Preferred dividends like interest on debts create a legal obligation on the company. The dividends for this type of stock are usually higher than those issued for common stock. The liability of the company to pay preferred dividends is unconditional and absolute.

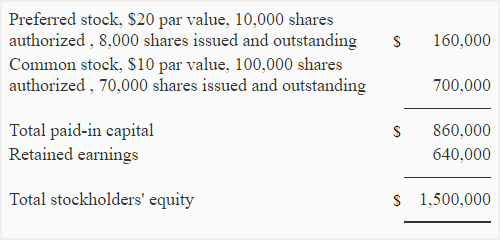

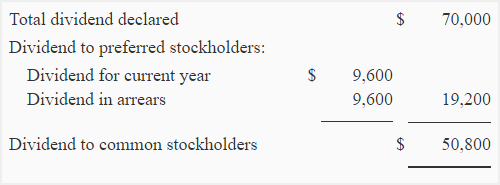

Preferred stockholders must be paid their due dividends before the company can distribute dividends to common stockholders. The most common are common shares and preferred shares. Its a form of return on their investment in the company.

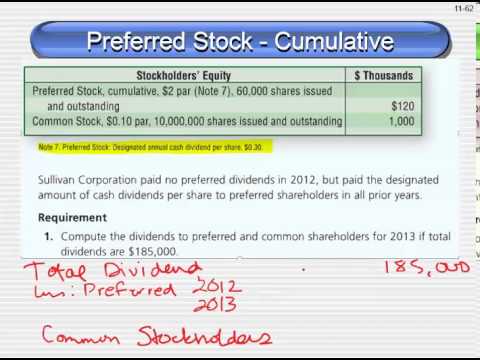

Preferred stock is a good alternative for risk averse investors wanting to buy equitiesin general they are less volatile then common stock and provide a better stream of dividends. In addition recall that cumulative preferred requires that unpaid dividends become dividends in arrears. Recall that preferred dividends are expected to be paid before common dividends and those dividends are usually a fixed amount eg a percentage of the preferreds par value.

Preferred dividends are cash distributions that are paid to the owners of a companys preferred shares. Many large corporations have multiple classes of stock. The preferred stock issued by a corporation may be cumulative or noncumulative.

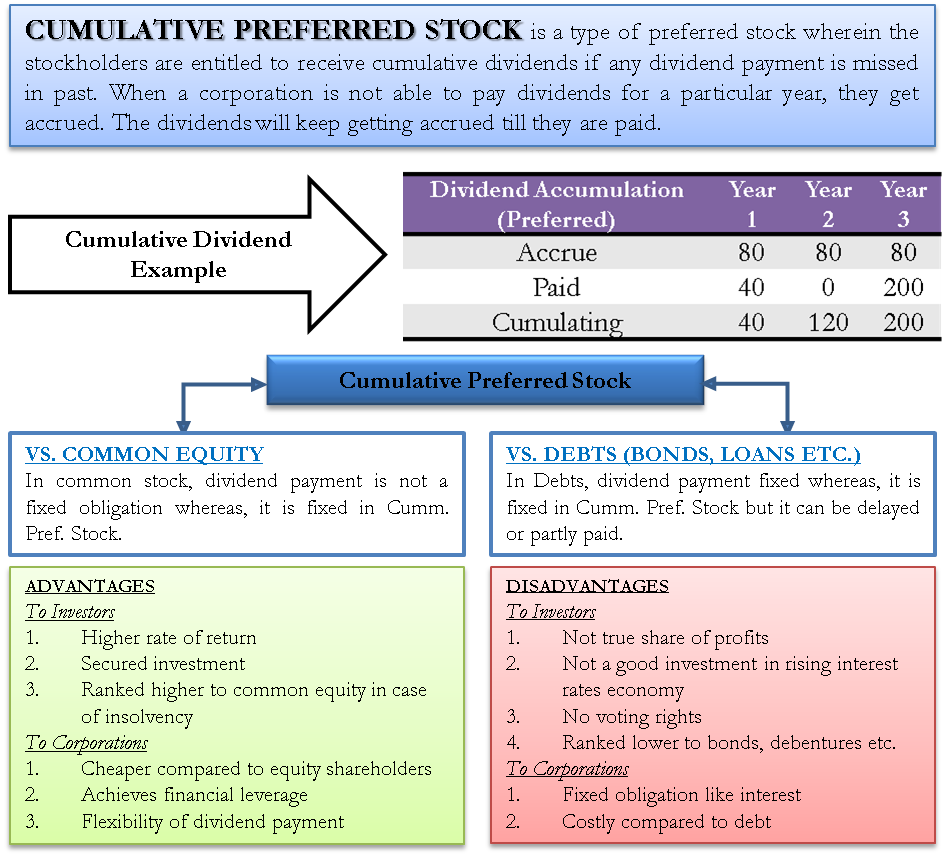

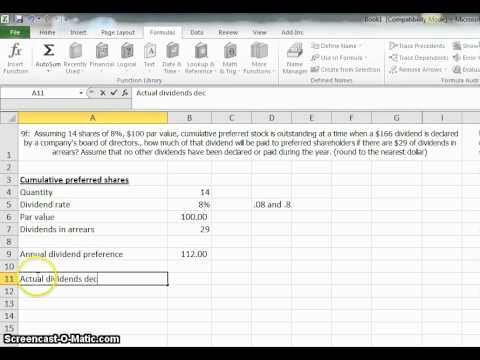

Calculation of cumulative preferred dividends. In case of cumulative preferred stock any unpaid dividends on preferred stock are carried forward to the future years and must be paid before any dividend is paid to common stockholders. We look at both cummulative and noncummulative preferred stock and.

This page briefly explains the difference between cumulative and noncumulative preferred stock. When the board of directors declares dividends common stockholders have the right to receive a percentage of dividends available to common stock equal to their ownership in the company. Dividends are the payment of retained earnings to shareholders.

In other words this is the amount of money preferred shareholders receive from the companys retained earnings each year. These are to be paid to shareholders in preference over any common stock dividend. Company a has 3000000 million issue of cumulative preferred stock comprising of 100000 shares each carrying 3 dividend per annum.

In case of cumulative preferred stock dividends to common stock holders cant be paid until preferred dividends for the current and prior periods are paid.

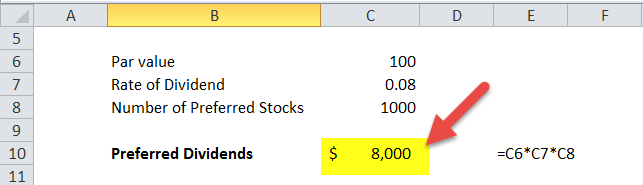

Preferred Dividend Formula Calculator Excel Template

Preferred Dividend Formula Calculator Excel Template

Cumulative Preferred Stock Define Example Benefits

Cumulative Preferred Stock Define Example Benefits

Preferred Stock Dividends Example

Preferred Stock Dividends Example

Cumulative And Noncumulative Preferred Stock Explanation

Cumulative And Noncumulative Preferred Stock Explanation

Cumulative And Noncumulative Preferred Stock Explanation

Cumulative And Noncumulative Preferred Stock Explanation

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S

Entries For Cash Dividends Financial Accounting

Entries For Cash Dividends Financial Accounting

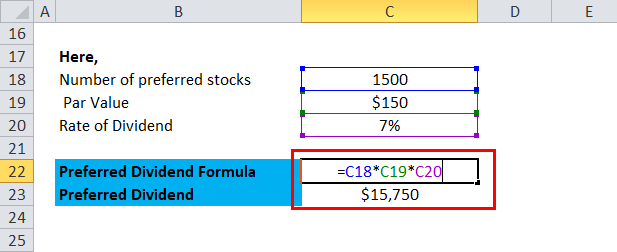

Preferred Dividend Formula Calculator Excel Template

Preferred Dividend Formula Calculator Excel Template

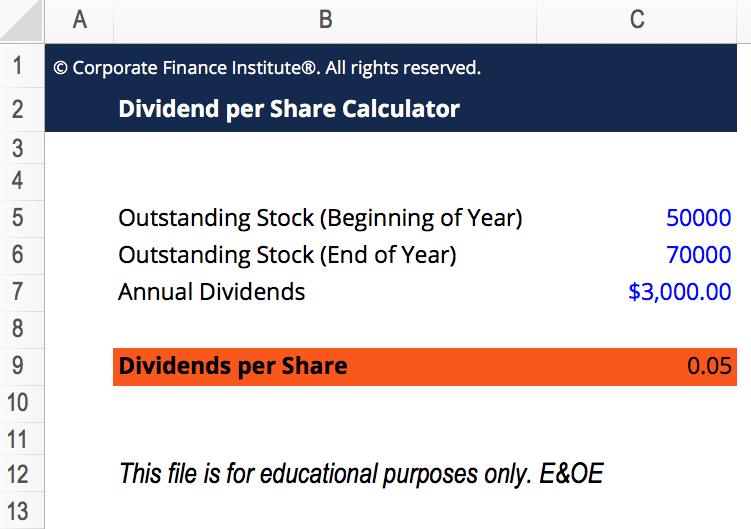

Dividend Per Share Overview Guide To Calculate Dividends

Dividend Per Share Overview Guide To Calculate Dividends

Common And Preferred Stock Principlesofaccounting Com

Common And Preferred Stock Principlesofaccounting Com

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends