How To Calculate Intrinsic Value Of Common Stock

Intrinsic value formula value of the company no. In a broad sense using an intrinsic value formula to calculate that value gives you the opportunity to decide whether or not to buy or sell a company.

5 Ways To Calculate Intrinsic Value Wikihow

5 Ways To Calculate Intrinsic Value Wikihow

how to calculate intrinsic value of common stock

how to calculate intrinsic value of common stock is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate intrinsic value of common stock content depends on the source site. We hope you do not use it for commercial purposes.

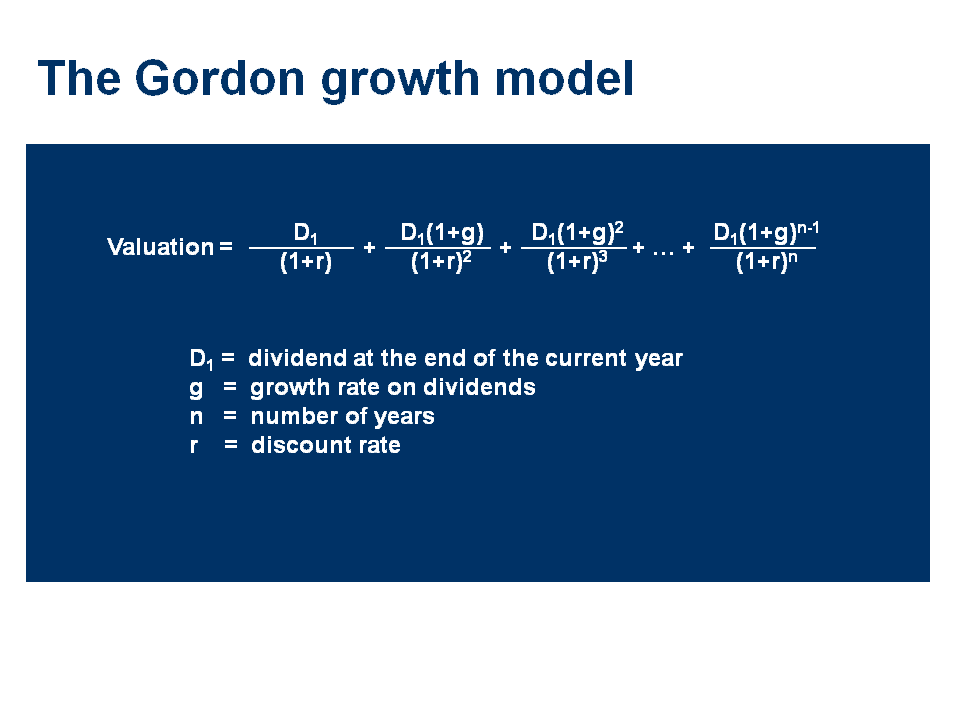

The gordon growth model or the dividend discount model ddm is a model used to calculate the intrinsic value of a stock based on the present value of future dividends that grow at a constant rate.

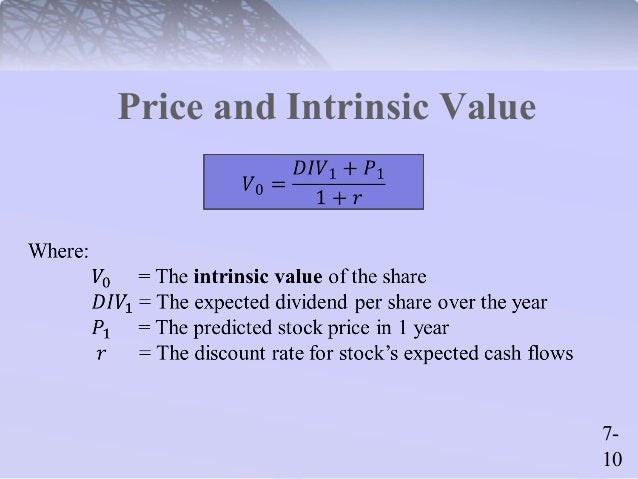

How to calculate intrinsic value of common stock. How to calculate the intrinsic value of your common. Relevance and use of intrinsic value formula. Is the intrinsic value of the stock you are buying lower than the price.

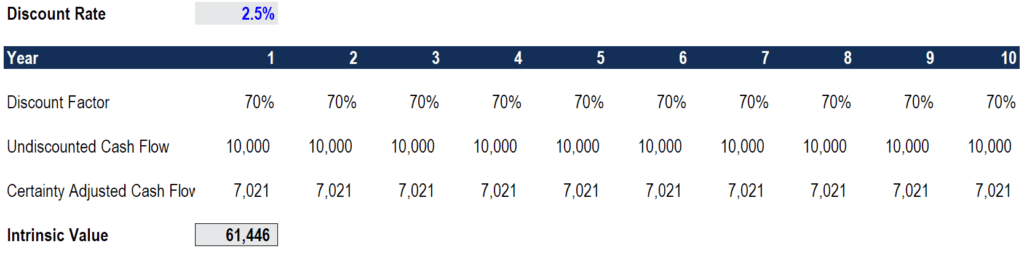

A company might have great properties but no stock is worth an infinity amount of dollars. 6250 is the intrinsic value of the stock using this model. If the current market price of the stock is less than 6250 the model indicates that the stock is undervalued.

Great then it is now time to calculate the companys intrinsic value to determine whether the stock price is low enough to invest. Why does intrinsic value matter. The following quote provides a definition of the term intrinsic value.

Analysts use these formulas to determine whether to assign undervalued or overvalued tag to their analysis of a company. Make when attempting to calculate intrinsic value is that they are too strict or. Of stock no more than 1 times net asset value.

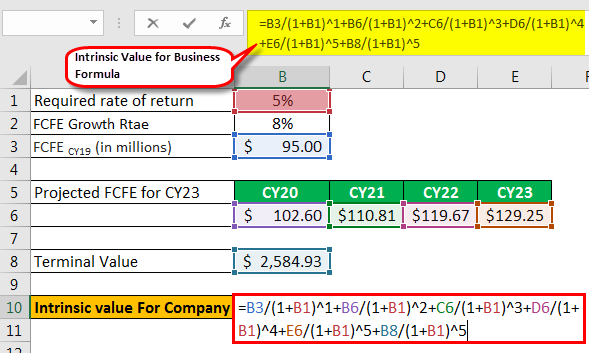

First he teaches us that the intrinsic value is simple nothing more than the discounted cash flow from that company. This is an advanced guide on how to calculate intrinsic value of a company with detailed interpretation analysis and exampleyou will learn how to use the dcf formula to estimate the value of a company. Use the formula to calculate intrinsic value.

This lesson presents direct quotes from warren buffett. If you have the dividend payout growth rate and needed return. Therefore the stock is trading below its fair value and as such it is advisable to purchase the stock at present as it is likely to increase in the future to attain the fair value.

If its intrinsic value drops by 3 a year later you are still saving at least 2 from your. Intrinsic value is the discounted value of the cash that can be taken out of a business during its remaining life. Principles of finance class intrinsic value of a stock.

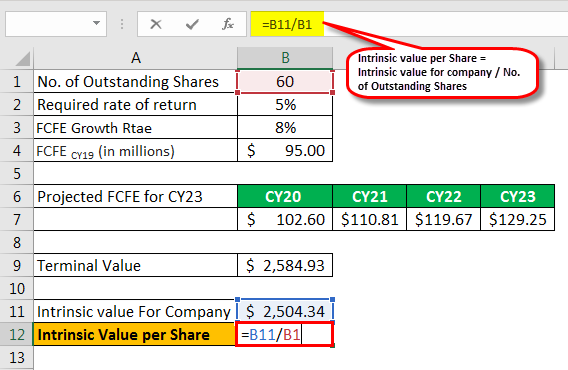

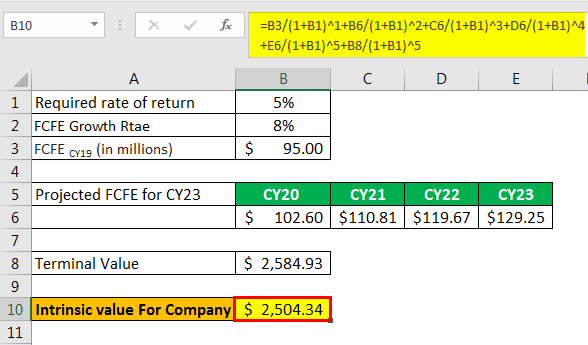

Of outstanding shares 250434 mn 60 mn 4174. The gordon growth model would be 5 10 2 6250. Assuming you have a margin of safety of about 35 you would purchase this stock at the 10 value.

Intrinsic Value Formula Example How To Calculate

Intrinsic Value Formula Example How To Calculate

5 Ways To Calculate Intrinsic Value Wikihow

5 Ways To Calculate Intrinsic Value Wikihow

Intrinsic Value Formula Example How To Calculate

Intrinsic Value Formula Example How To Calculate

Dividend Growth Model How To Calculate Stock Intrinsic Value

Dividend Growth Model How To Calculate Stock Intrinsic Value

Intrinsic Value Learn How To Calculate Intrinsic Value Of

Intrinsic Value Learn How To Calculate Intrinsic Value Of

Intrinsic Value Formula Example How To Calculate

Intrinsic Value Formula Example How To Calculate

Chapter 7 Valuing Stocks Topics Covered Stocks And The Stock

Chapter 7 Valuing Stocks Topics Covered Stocks And The Stock

Intrinsic Value Formula Examples Of Intrinsic Value With

Intrinsic Value Formula Examples Of Intrinsic Value With

Intrinsic Value Learn How To Calculate Intrinsic Value Of

Intrinsic Value Learn How To Calculate Intrinsic Value Of

5 Ways To Calculate Intrinsic Value Wikihow

5 Ways To Calculate Intrinsic Value Wikihow