What Is Netting In Forex

Regarding foreign exchange businesses may use netting strategies to protect themselves against exchange rate risk. There are still several forex brokers which offer you with both account types.

Matching And Netting Agreements

Matching And Netting Agreements

what is netting in forex

what is netting in forex is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in what is netting in forex content depends on the source site. We hope you do not use it for commercial purposes.

Netting strategies and international businesses.

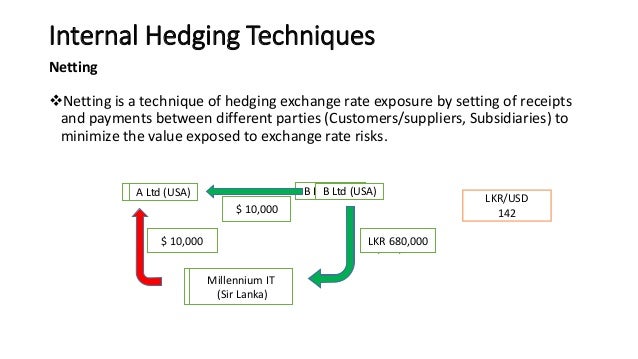

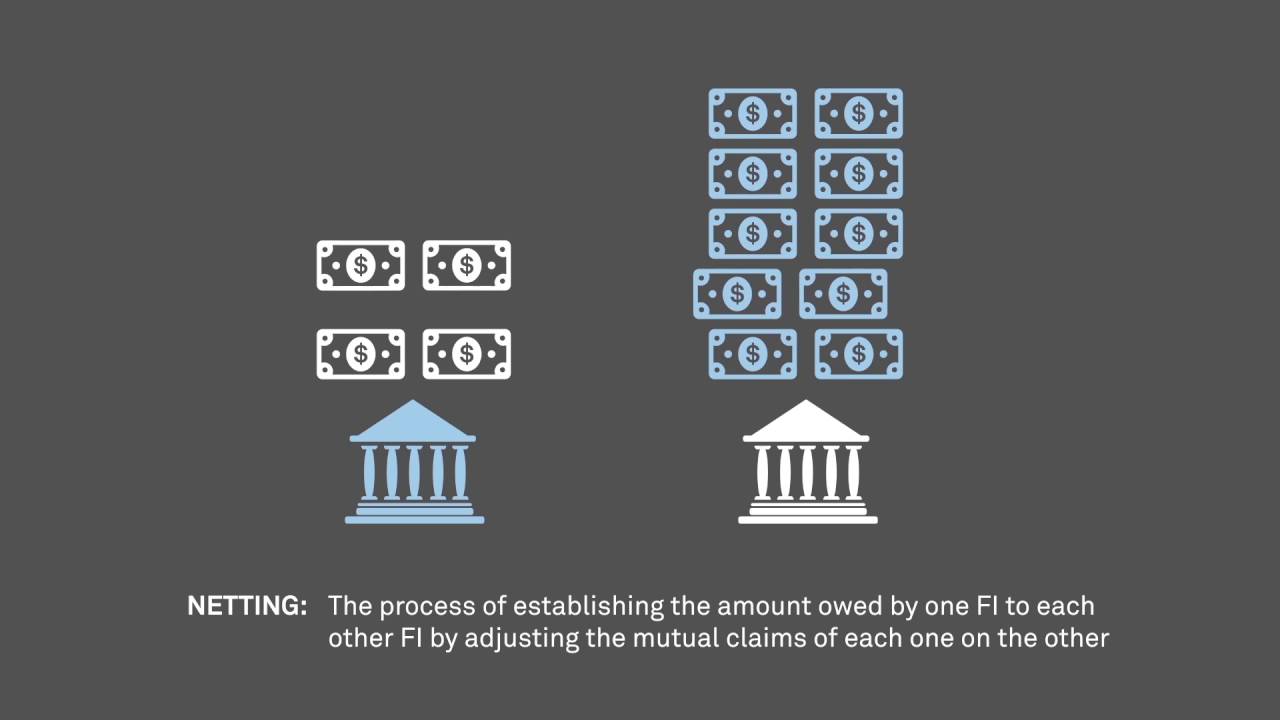

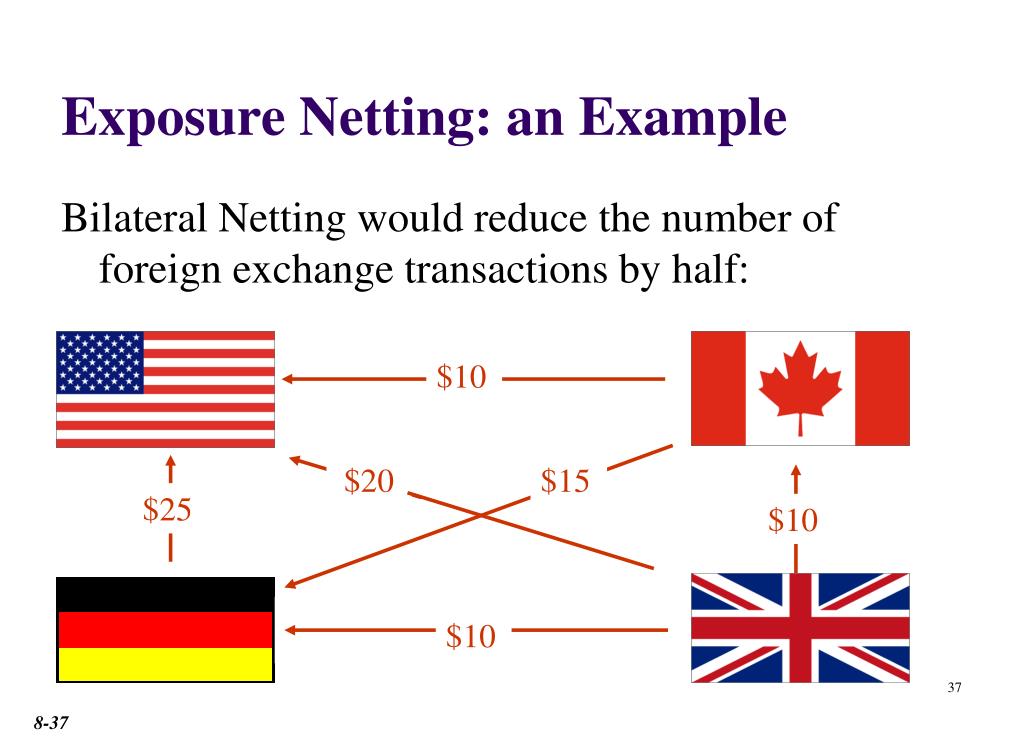

What is netting in forex. Exposure netting is a method of hedging currency risk by offsetting exposure in one currency with exposure in the same or another similar currency. For the purposes of this section settlement netting will be used in the general sense to refer to the various means of netting foreign exchange settlements and payment netting will refer to the mode of settlement netting that occurs just prior to value date. In order to expand possibilities of retail forex traders we have added the second accounting system hedging.

A centralized netting function may be used which means that each subsidiary either receives a single payment from the netting center or makes a single payment to the netting center. Old simple and limited netting system. The netting system allows having only one position per financial instrument meaning that all further operations at that instrument lead only to closing reversal or changing the volume of the already existing position.

Foreign exchange exposure is no longer tracked at the subsidiary level. By referring to herculesfinance you can find all latest newsinformation financial technicalfundamental analysis mainexclusive bonus promotions of partnered companies and a number of educational materials of finance. Exposure netting has the objective of reducing a.

Netting results in the following benefits. It is very rare that a forex broker adopts the netting system for its clients accounts. Among hundreds of forex brokers in the world it is very normal that a forex broker adopts hedging system for all trading accounts.

A company exposed to a specific foreign currency may offset transaction risks by holding equal amounts of foreign receivables and foreign payables denominated in that currency. On the other hand it is very rare to find a broker with netting system nowadays. Netting entails offsetting the value of multiple positions or payments due to be exchanged between two or more parties.

It can be used to determine which party is owed remuneration in a multiparty. 3 the terms settlement netting and payment netting are often used interchangeably.

Fx Risk Management By Netting Technique Why When How

Fx Risk Management By Netting Technique Why When How

Fx Risk Management By Netting Technique Why When How

Fx Risk Management By Netting Technique Why When How

Fx Risk Management By Netting Technique Why When How

Netting In Finance An Immersive Guide To Global

Netting In Finance An Immersive Guide To Global

Guidelines For Foreign Exchange Settlement Netting Pdf

Guidelines For Foreign Exchange Settlement Netting Pdf

Module 1 Chapter 8 Netting And Settlement

Module 1 Chapter 8 Netting And Settlement

Ppt Chapters 8 9 10 Exchange Risk Exposures Powerpoint

Ppt Chapters 8 9 10 Exchange Risk Exposures Powerpoint

/GettyImages-539090008-7cc20448f6884aceb72fbca172a8c799.jpg)

:max_bytes(150000):strip_icc()/GettyImages-942218138-4fa5efbe74b24e52a7c839c6e1893881.jpg)

:max_bytes(150000):strip_icc()/GettyImages-183795783-77c63e70485f417f8cdcb6d7bc083796.jpg)