A Portfolio Is Composed Of Two Stocks

Stock a has a standard deviation of return of 5 while stock b has a standard deviation of return of 15. Stock a has a standard dev.

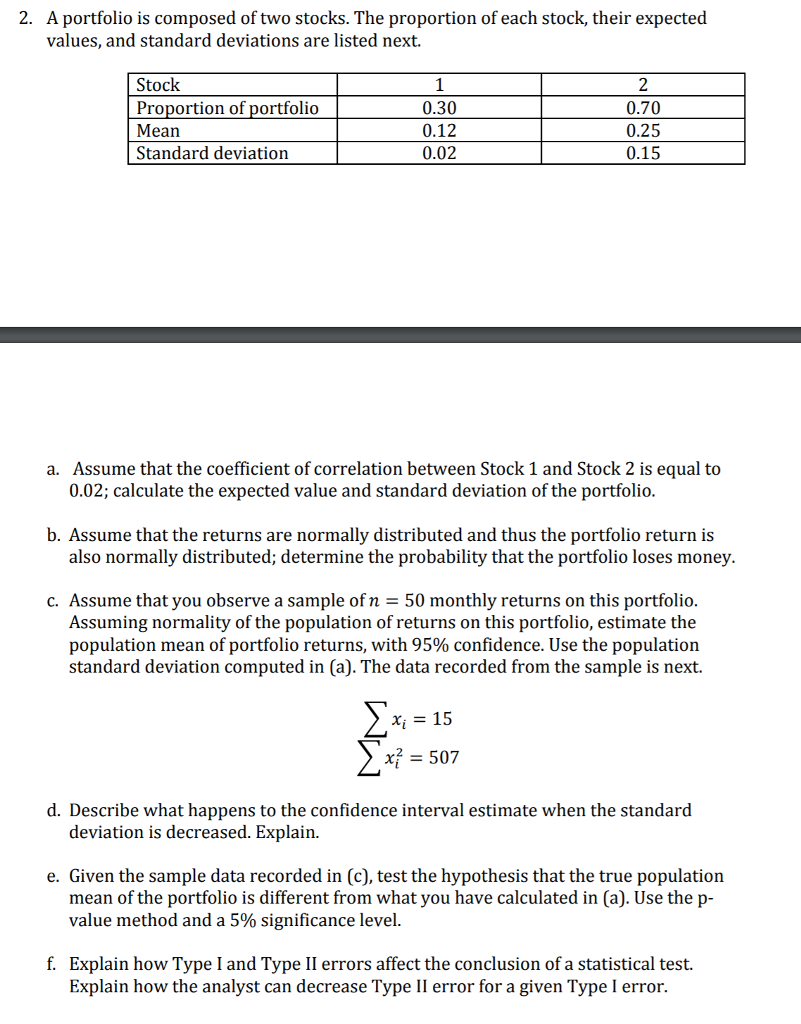

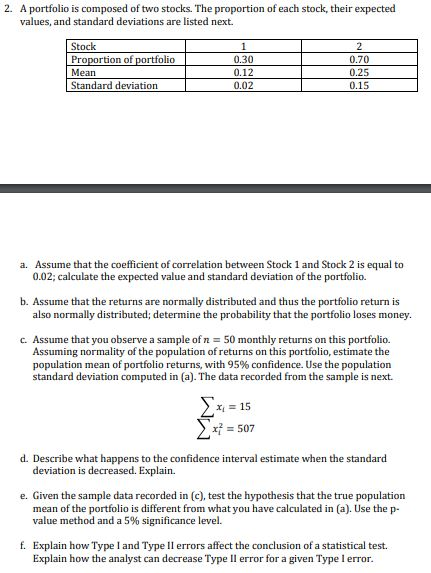

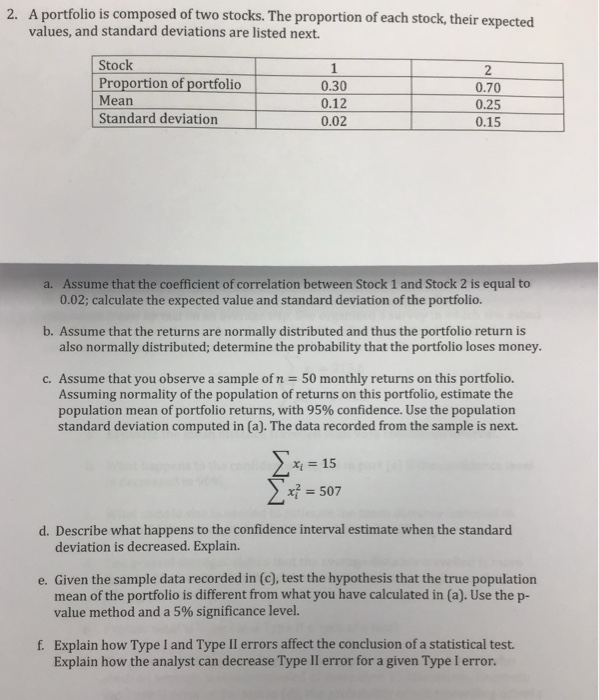

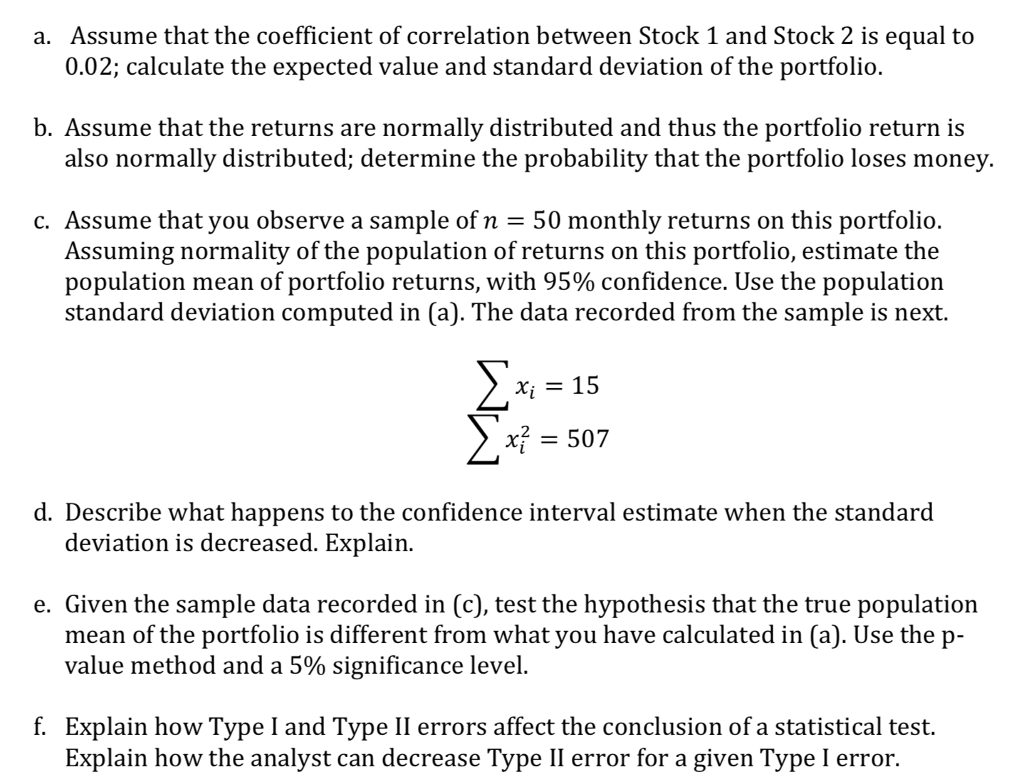

Solved 2 A Portfolio Is Composed Of Two Stocks The Prop

Solved 2 A Portfolio Is Composed Of Two Stocks The Prop

a portfolio is composed of two stocks

a portfolio is composed of two stocks is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in a portfolio is composed of two stocks content depends on the source site. We hope you do not use it for commercial purposes.

Stock a has a standard deviation of return of 35 while stock b has a standard deviation of return of 15.

A portfolio is composed of two stocks. Fin mcq fin 332 a portfolio is composed of two stocks a and b. Stock a has a standard deviation of return of 3 while stock b has a standard deviation of return of 3. If the variance of return on the portfolio is 00380.

Stock a comprises 60 of the portfolio while stock b comprises 40 of the portfolio. Stock a comprises 40 of the portfolio while stock b comprises 60 of the portfolio. Expected return and variance for a two asset portfolio.

If the variance of return on the portfolio is 030 the correlation coefficient between the returns on a and b is. Stock a comprises 60 of the portfolio while stock b comprises 40 of the portfolio. A portfolio is composed of two stocks a and b.

Stock a comprises 40 of the portfolio while stock b comprises 60 of the portfolio. Stock a has a standard deviation of return of 35 while stock b has a standard deviation of return of 15. A portfolio is composed of 2 stocks a and b.

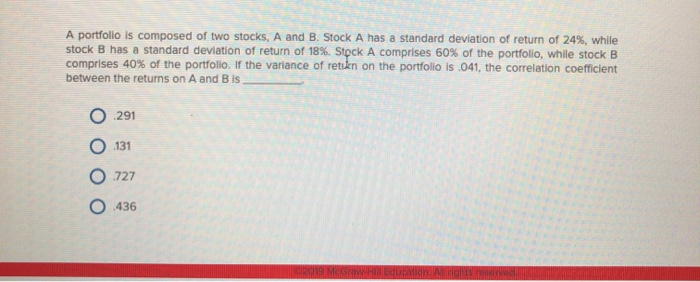

Stock a has a standard deviation of return of 24 while stock b has a standard deviation of return of 18. Expected return for a two asset portfolio the expected return of a portfolio is equal to the weighted average of the returns on individual assets in the. Of return of 24 while stock b has a standard dev.

The correlation coefficient between the returns on a and b is 45. Stock a has a standard deviation of return of 20 while stock b has a standard deviation of return of 15. Stock a comprises 40 of the portfolio while stock b comprises 60 of the portfolio.

A portfolio is composed of two stocks a and b. A portfolio is composed of two stocks a and b. Of return of 18.

A portfolio is composed of two stocks a and b. Stock a comprises 60 of the portfolio while stock b comprises 40 of the portfolio. Stock a compromises 60 of the portfolio while stock b compromises 40 of the portfolio.

Cfa exam cfa exam level 2 portfolio management. Stock a has a standard deviation of return of 19 while stock b has a standard deviation of return of 25. Stock a has a standard deviation of return of 24 while stock b has a standard deviation return of 18.

A portfolio is composed of two stocks a and b. A portfolio is composed of two stocks a and b. Stock a comprises 70 of the portfolio while stock b comprises 30 of the portfolio.

The correlation coefficient between the returns on a and b is 5. The correlation coefficient between the returns on a and b is 45. A portfolio is composed of two stocks a and b.

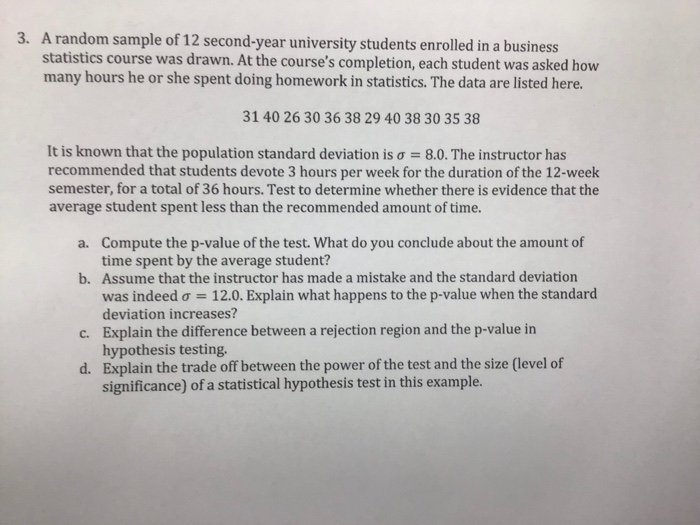

Solved 2 A Portfolio Is Composed Of Two Stocks The Prop

Solved 2 A Portfolio Is Composed Of Two Stocks The Prop

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved A Portfolio Is Composed Of Two Stocks The Proport

Solved Mc Qu 02 A Portfolio Is Composed Of Two Stocks A

Solved Mc Qu 02 A Portfolio Is Composed Of Two Stocks A

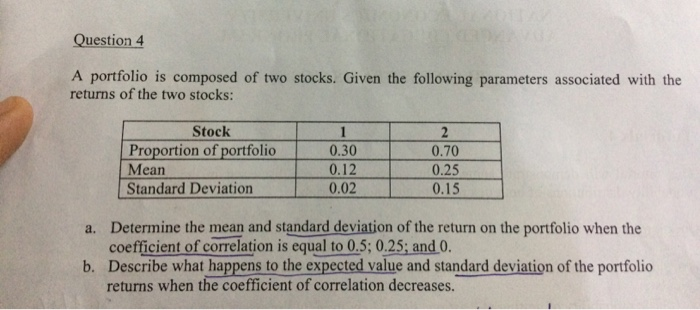

Solved Question 4 A Portfolio Is Composed Of Two Stocks

Solved Question 4 A Portfolio Is Composed Of Two Stocks

Solved 5 A Portfolio Is Composed Of Two Stocks A And B

Solved 5 A Portfolio Is Composed Of Two Stocks A And B

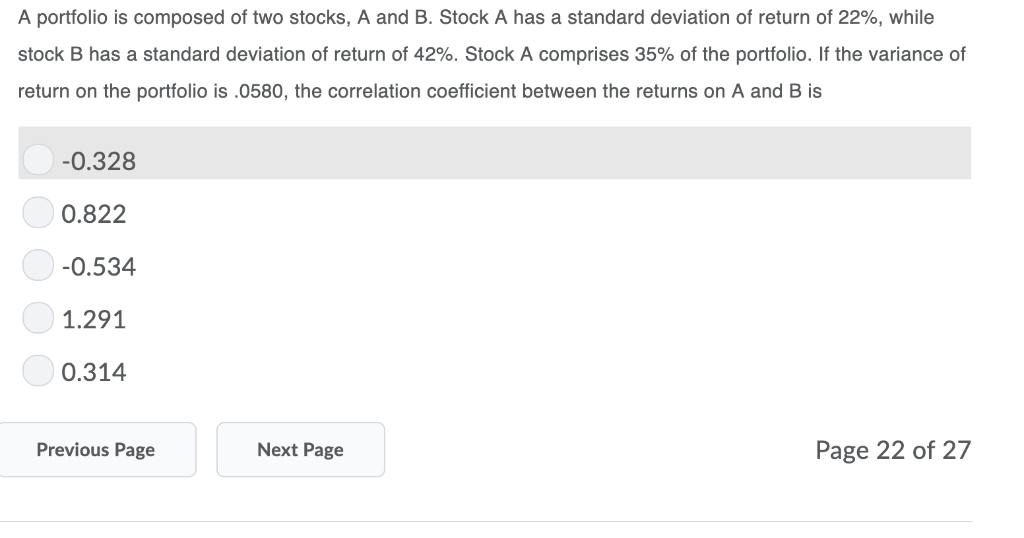

Solved A Portfolio Is Composed Of Two Stocks A And B St

Solved A Portfolio Is Composed Of Two Stocks A And B St

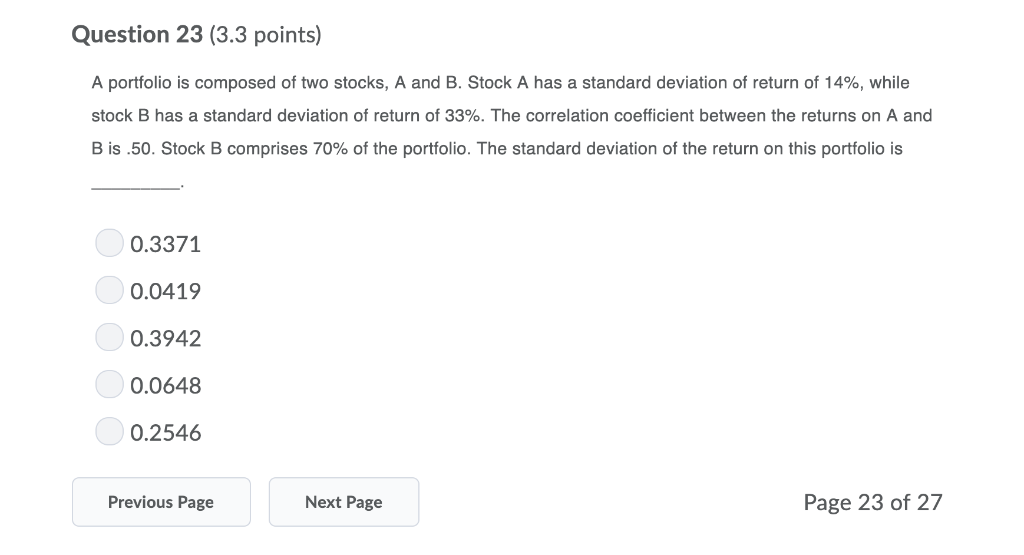

Solved Question 23 3 3 Points A Portfolio Is Composed O

Solved Question 23 3 3 Points A Portfolio Is Composed O

Solved A Portfolio Is Composed Of Two Stocks A And B St

Solved A Portfolio Is Composed Of Two Stocks A And B St