Bid And Ask Meaning In Stock Market

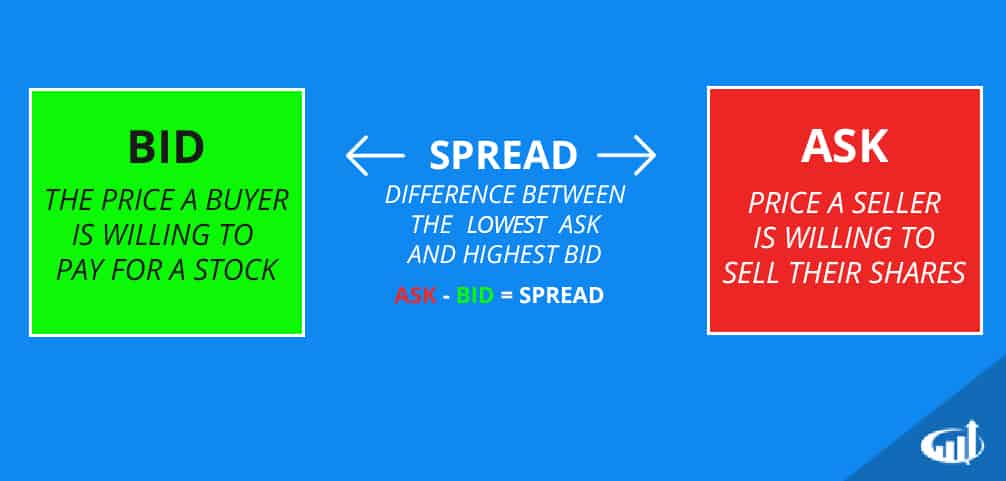

Id like to welcome anyone with any questions to message me or email me as i would love to be a part of your success. If a bid is 1005 and the ask is 1006 the bid ask spread would then be 001.

bid and ask meaning in stock market

bid and ask meaning in stock market is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in bid and ask meaning in stock market content depends on the source site. We hope you do not use it for commercial purposes.

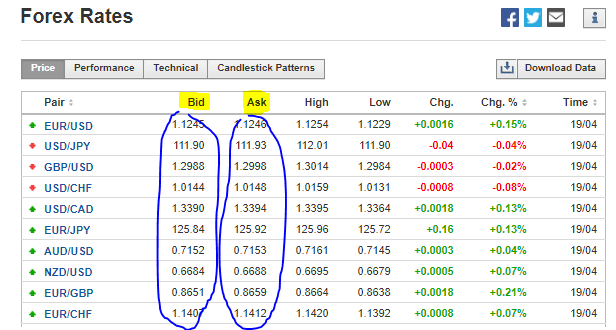

Certain large firms called market makers can set a bidask spread by offering to both buy and sell a given stockfor example the market maker would quote a bidask spread for the stock as 20402045 where 2040 represents the price at which the market maker would buy the stock.

Bid and ask meaning in stock market. Whereas the bid and ask are the best potential prices that buyers and sellers are willing to transact at. What is the bid and ask. What is the meaning of market trading stock ask.

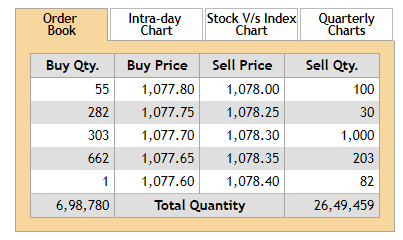

The bid ask spread is one of the important trading points in the derivatives market and traders use it as an arbitrage tool to make little money by keeping a check on the ins and outs of bid ask spread. Ask price of a stock. For those who are interested in trading penny stock or investing join my group.

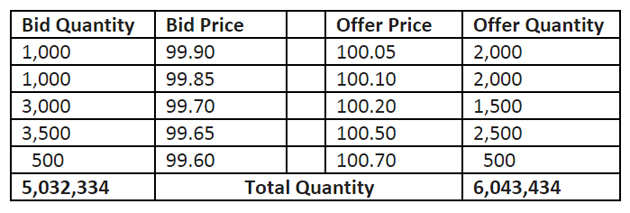

Bid and ask prices are the key components of a stock quote. Bid ask spread is used in following arbitrage trades. What happens when bid and ask are far apart.

The bid ask spread can widen dramatically during periods of illiquidity or market turmoil since traders will not be willing to pay a price beyond a certain threshold and sellers may not be. Should i buy at the bid or ask price. The bid ask spread can affect the.

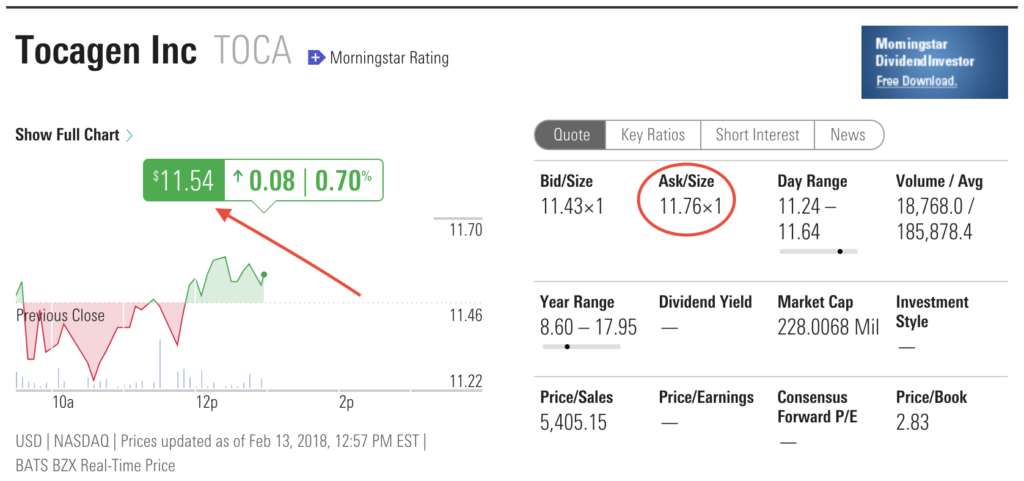

However this is simply the monetary value of the spread. The price that someone has offered to pay for a stock. Stock market ask and bid price definitions.

When an investor comes to the market to buy or sell a stock a quote tells him the lowest price at which he can buy the ask and the highest price at which he can sell the bid. The easiest way to understand it. The bid for the buying side and the ask for the selling side.

Bid to cover ratio is a ratio used to express the demand for a particular security during offerings and auctions. What is a normal bidask spread. The bid ask spread can be measured using ticks and pipsand each market is measured in different increments of ticks and pips.

The terms spread or bid ask spread is essential for stock market investors but many people may not know what it means or how it relates to the stock market. Why is the bid and ask price so different. The current stock price youre referring to is actually the price of the last tradeit is a historical price but during market hours thats usually mere seconds ago for very liquid stocks.

Bid Ask And Spread Level 2 Day Trading Strategies

Bid Ask And Spread Level 2 Day Trading Strategies

All You Need To Know About Bid Ask Spreads And Its

All You Need To Know About Bid Ask Spreads And Its

Vantage Point Trading Bid Ask And Last Price

Vantage Point Trading Bid Ask And Last Price

Bid Vs Ask Price Of Stock Top 6 Best Differences With

Bid Vs Ask Price Of Stock Top 6 Best Differences With

Bid Vs Ask Price Of Stock Top 6 Best Differences With

Bid Vs Ask Price Of Stock Top 6 Best Differences With

What Is The Bid And Ask Spread Thinkmarkets

What Is The Bid And Ask Spread Thinkmarkets

How Would You Explain The Concept Of Bid Ask Bounce In

Bid Ask Spread Free Trades Aren T Free Define Financial

Bid Ask Spread Free Trades Aren T Free Define Financial

Ask Price Vs Bid Price Difference And Comparison Diffen

Ask Price Vs Bid Price Difference And Comparison Diffen