Calculate The Expected Return For Stock A

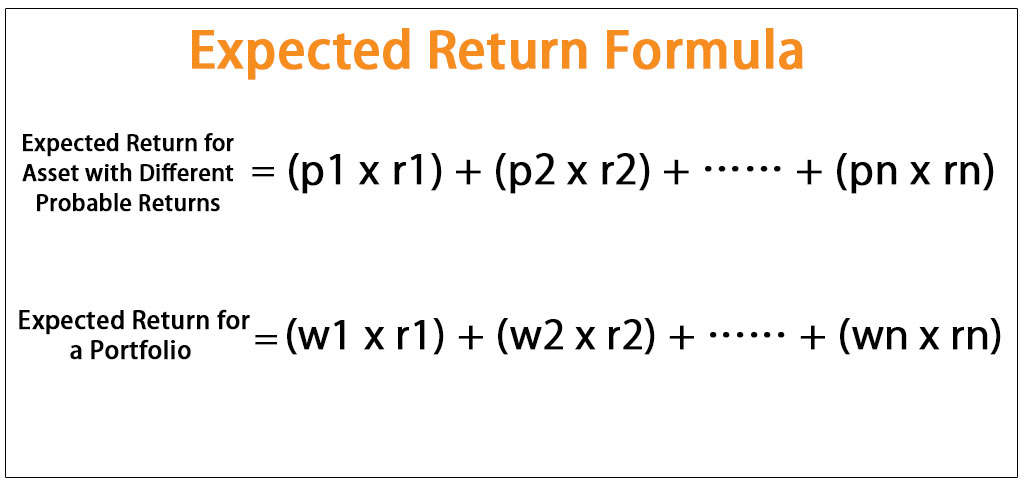

The formula is the following. My future return assumptions for stocks bonds and gold for 2020 and beyond.

Expected Return How To Calculate A Portfolio S Expected Return

Expected Return How To Calculate A Portfolio S Expected Return

calculate the expected return for stock a

calculate the expected return for stock a is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in calculate the expected return for stock a content depends on the source site. We hope you do not use it for commercial purposes.

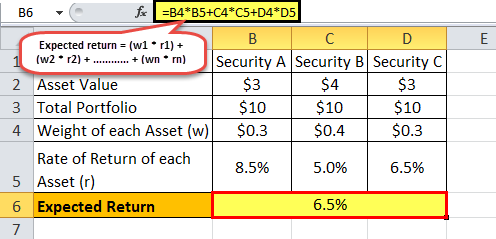

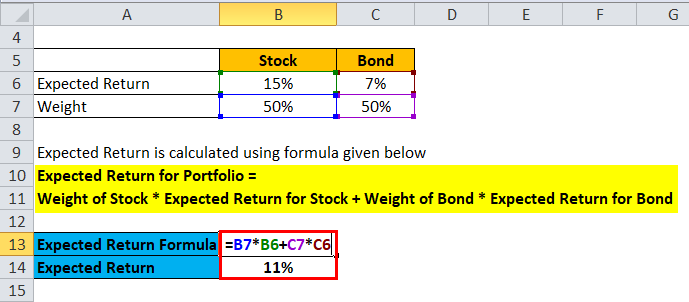

Here we learn how to calculate expected return of a portfolio investment using practical examples and downloadable excel template.

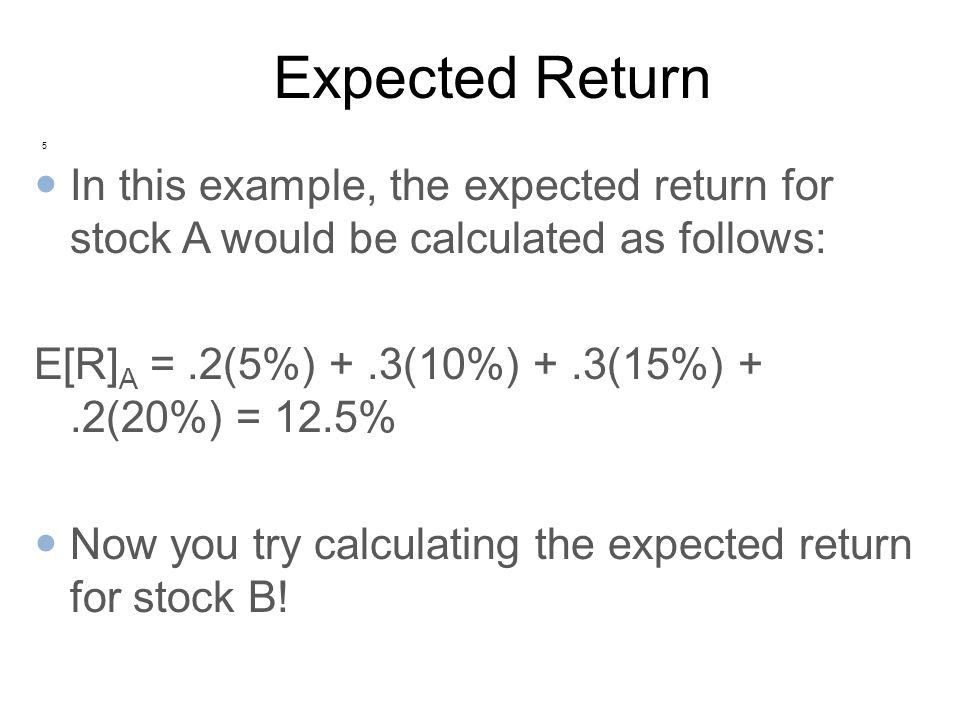

Calculate the expected return for stock a. How to calculate expected return of a stock. Investing ideas if return assumptions dont match. The capital asset.

In short the higher the expected return the better is the asset. Total return differs from stock price growth because of. Understand the expected rate of return formula.

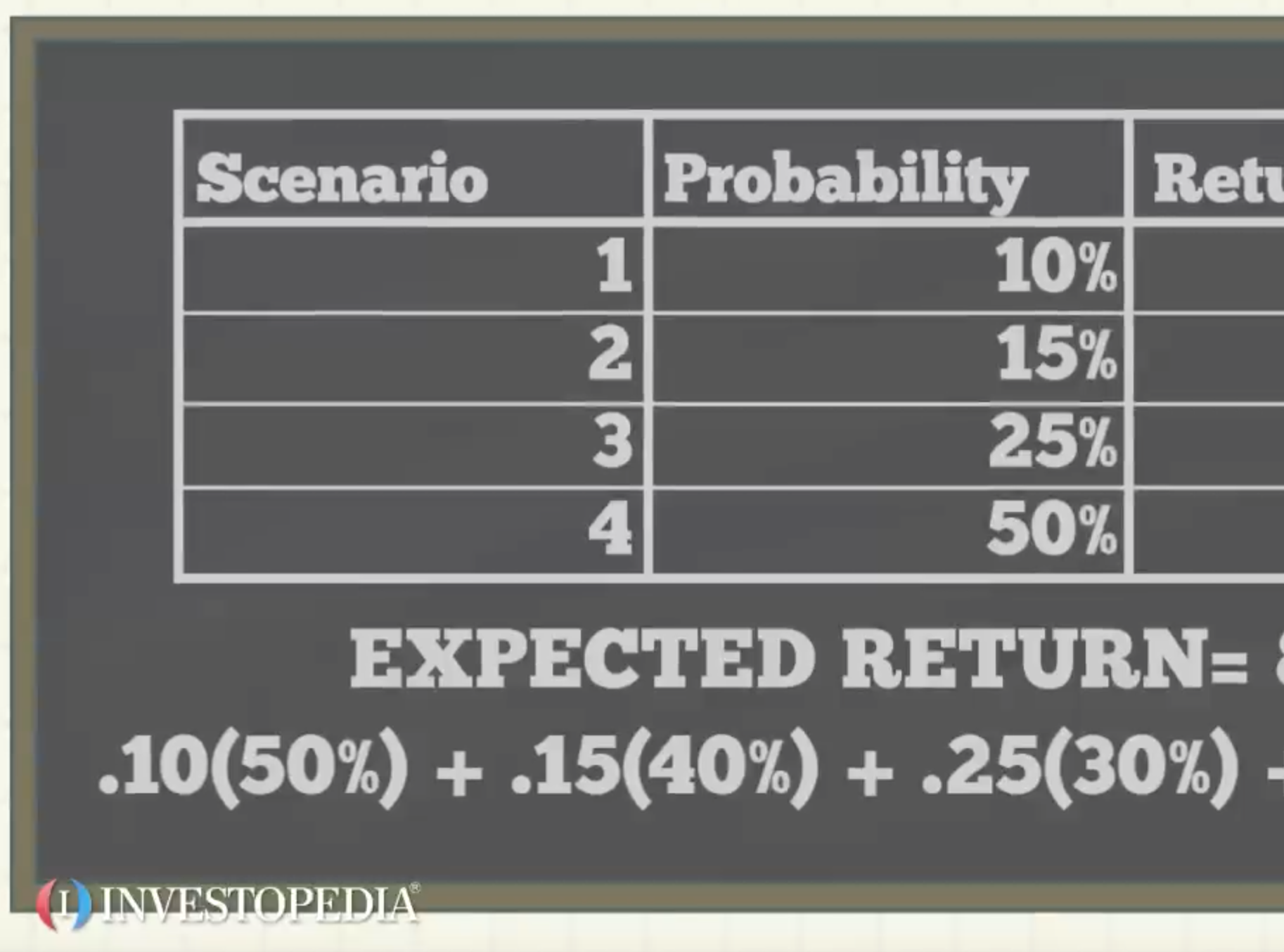

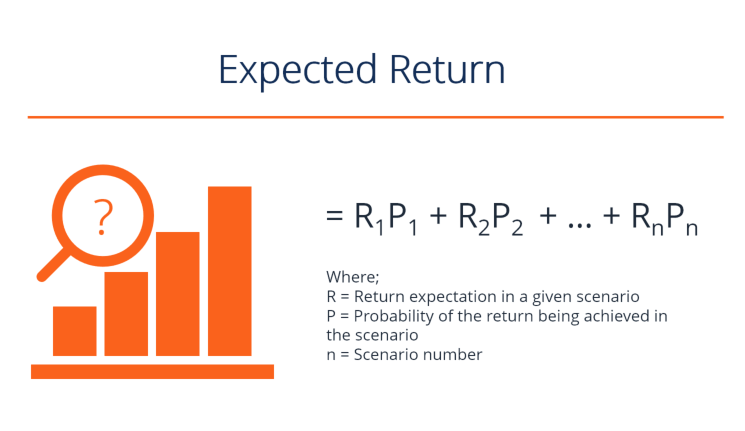

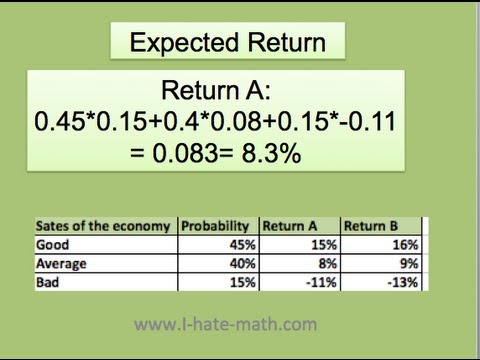

Note that although the simple average of the expected return of the portfolios components is 15 the average of 10 15 and 20 the portfolios expected return of 14 is slightly below that simple average figure. Like many formulas the expected rate of return formula requires a few givens in order to solve for the answer. The givens in this formula are the probabilities of different outcomes and what those outcomes will return.

Stock non constant growth calculator. This is due to the fact that half of the investors capital is invested in the asset with the lowest expected return. Rather its a tool used to determine.

You can learn more about financial analysis from the following articles. Stock constant growth calculator. This has been a guide to the expected return formula.

How to value the stock and bond markets and project future returns. It includes all capital gains and any dividends or interest paid. Expected return is the amount of profit or loss an investor can anticipate receiving on an investment.

Weighted average cost of capital calculator. Total return is the full return of an investment over a given time period. Based on historical data its not a guaranteed result.

In this video i will show you how to calculate expected return variance standard deviation in ms excel from stocksshares or investment on stocks for making portfolio. Holding period return calculator. To calculate the err you first add 1 to the decimal equivalent of the expected growth rate r and then multiply that result by the current dividend per share dps to arrive at the future dividend per share.

Solved Calculate The Expected Return For Each Stock Do

Solved Calculate The Expected Return For Each Stock Do

How To Find The Expected Return And Risk

How To Find The Expected Return And Risk

Expected Return Formula Calculate Portfolio Expected

Expected Return Formula Calculate Portfolio Expected

Expected Return Formula Calculator Excel Template

Expected Return Formula Calculator Excel Template

Solved Consider The Following Information Calculate The

Solved Consider The Following Information Calculate The

Solved You Have A Threestoclc Portl Olio Stock A Has An

Expected Return Formula Calculate Portfolio Expected

Expected Return Formula Calculate Portfolio Expected

Measuring Returns Converting Dollar Returns To Percentage

Measuring Returns Converting Dollar Returns To Percentage

A Calculate The Expected Return Of Each Stock B

A Calculate The Expected Return Of Each Stock B

Risk Return Problems 7 Calculating Returns And Deviations