Can I Choose Individual Stocks In My 401k

Individuals have a range of options when choosing suitable investments choices for a 401k plan. Too but id rather use a different investment account for that.

5 Reasons You Should Own Stocks Instead Of Mutual Funds Or

5 Reasons You Should Own Stocks Instead Of Mutual Funds Or

can i choose individual stocks in my 401k

can i choose individual stocks in my 401k is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i choose individual stocks in my 401k content depends on the source site. We hope you do not use it for commercial purposes.

Employers allow workers to contribute to 401ks from.

Can i choose individual stocks in my 401k. Can i choose individual stocks in my 401k. Participants in 401k plans might feel restricted by the narrow slate of mutual fund offerings available to them. When you contribute to a 401k you put a percentage of your income in and you dont have to pay taxes on that money or.

90 large blend domestic stocks vanguard institutional. Younger people with a longer time to invest may want to choose stocks that tend to gain over the long term but may lose money in the short run. How to use a 401k to buy private stocks.

This article assumes that your 401k comes with the option to invest in individual stocks but many plans do not. Can i choose individual stocks in my 401k. And this is what i would choose.

Can i choose individual stocks in my 401k. Older workers nearing retirement often prefer mutual funds that are less subject to stock market volatility or fixed income investments. Im also a finance nerd and actually enjoy researching companies.

The 401k is a great investment tool especially for retirement planning but most dont give you the option to pick privately held stocks directly and. How i pick my 401k funds in just 15 minutes february 19 2018. Can you invest your 401k in individual stocks.

Your plan may allow you to but that doesnt mean you should. Know thyself theres no question that investing in individual companies can grant your retirement account returns that even the market cant touch. And within individual funds investors have zero control to choose the underlying.

I invest in individual stocks for the most part outside of my 401k because i like the freedom to choose my path. I dont think i can beat the market or anything although i have for years. For my 401k i like to keep it pretty simple.

Employees can generally choose from mutual funds that are weighted toward stocks if they prefer market exposure while self directed 401k plans typically have more flexibility including the ability to directly trade individual stocks. And because i value simplicity i would only pick a few funds. A 401k is a type of retirement plan that allows employees to contribute before tax dollars into an account that builds until they reach retirement age.

I like to set up my portfolio so that i get paid dividends and options premiums. Though especially if youre new to investing and are unsure what to choose. One of the most useful tools for saving for retirement is an employer sponsored 401k plan.

5 Top Funds For Your 401 K The Motley Fool

5 Top Funds For Your 401 K The Motley Fool

Yes You Need A 401 K In Your 20s Here S Why Nerdwallet

Yes You Need A 401 K In Your 20s Here S Why Nerdwallet

How Are 401 K Withdrawals Taxed For Nonresidents

How Are 401 K Withdrawals Taxed For Nonresidents

How To Choose Whether To Invest In Cds Or Stocks Bankrate Com

How To Choose Whether To Invest In Cds Or Stocks Bankrate Com

Should I Contribute To My 401 K Or Pay Off Debt Human

Should I Contribute To My 401 K Or Pay Off Debt Human

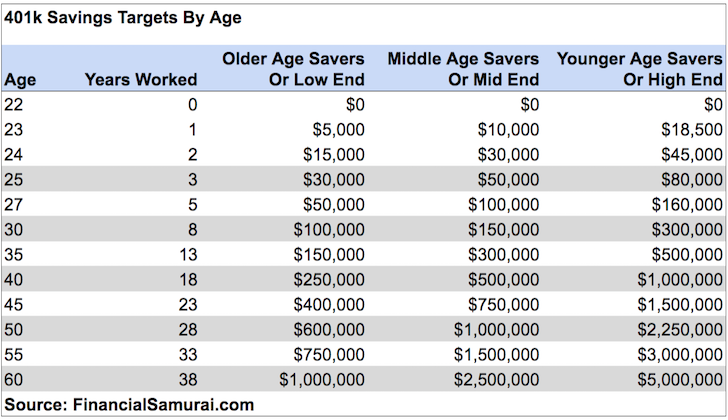

How Much Should People Have Saved In Their 401ks At

How Much Should People Have Saved In Their 401ks At

How To Trade Stocks In 3 Steps It S Easier Than You Think

How To Trade Stocks In 3 Steps It S Easier Than You Think

5 Top Funds For Your 401 K The Motley Fool

5 Top Funds For Your 401 K The Motley Fool

How To Successfully Manage Your 401 K

How To Successfully Manage Your 401 K

:max_bytes(150000):strip_icc()/IRAproviders-5c42006dc9e77c000173d373.jpg)