How To Calculate Option Price From Stock Price

Calculate call option value and profit by subtracting the strike price plus premium from the market price. Using the black and scholes option pricing model this calculator generates theoretical values and option greeks for european call and put options.

Understanding How Options Are Priced

how to calculate option price from stock price

how to calculate option price from stock price is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate option price from stock price content depends on the source site. We hope you do not use it for commercial purposes.

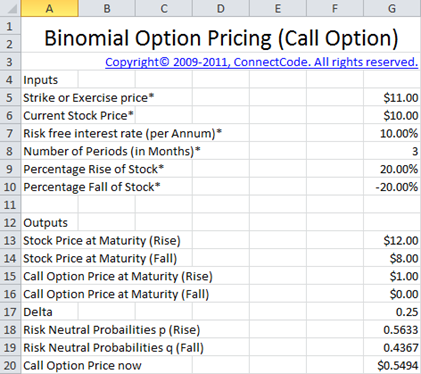

Have a look at the image below with all the input data loaded.

How to calculate option price from stock price. So for a 6 month option take the square root of 050 half a year. The price difference between the underlying stock price and the strike price determines an options value. For buyers of a call option if the strike price is above the underlying stock price the.

You invest 1share to pay the premium. Select volatility if you want the option calculator to calculate the volatility for you. Calculate the price of an atm option call and put that has 3 months until expiration.

Time ratio is the time in years that option has until expiration. If you want to calculate the theoretical option price select the option price. The underlying volatility is 23 and the current stock price is 45.

For example say a call stock option has a strike price of 30share with a 1 premium and you buy the option when the market price is also 30. Along with the greeks i intend to calculate the option price highlighted. As the price of a stock rises the more likely it is that the price of a call.

The movement of the price of the stock up or down has a direct although not equal effect on the price of the option. 04 023 sqrt25 45.

Understanding The Binomial Option Pricing Model

Understanding The Binomial Option Pricing Model

Understanding The Binomial Option Pricing Model

Understanding How Options Are Priced

Understanding How Options Are Priced

Binomial Option Pricing Model Definition

Stock Options Risk Free Rate Ey Estimating Risk Free

Option Calculator And Implied Volatilities

Binomial Option Pricing Tutorial And Spreadsheets

Free Options Valuation Put Call Parity Binomial Option

Free Options Valuation Put Call Parity Binomial Option

Option Price As A Function Of Asset Here Assumed To Be A

Option Price As A Function Of Asset Here Assumed To Be A