How To Calculate True Value Of A Stock

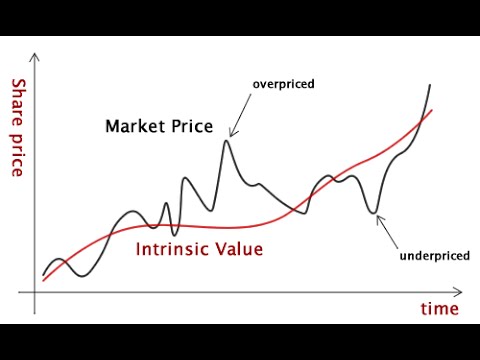

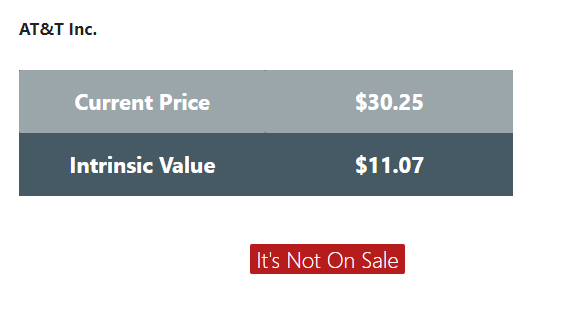

Many analysts believe that the market price of a particular stock does not represent the true value of the company. These analysts use intrinsic value to determine if a stocks price undervalues the.

How To Calculate Market Price Per Share

How To Calculate Market Price Per Share

how to calculate true value of a stock

how to calculate true value of a stock is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to calculate true value of a stock content depends on the source site. We hope you do not use it for commercial purposes.

Learn how to value stocks using a simple formula created by ben graham.

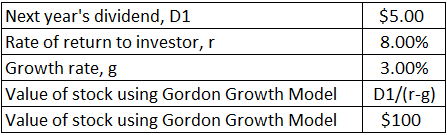

How to calculate true value of a stock. Learn the benjamin graham formula to calculate the intrinsic value of a stock using the original and revised graham formula and then walk through some examples. How do i calculate stock value. The gordon growth model or the dividend discount model ddm is a model used to calculate the intrinsic value of a stock based on the present value of future dividends that grow at a constant rate.

What is important to consider though is how this valuation method derives the value of the stock based on the difference in earnings per share and per share book value in this case the security. While the share price is the first and most obvious indicator of a stocks value there are other factors to consider. What is a stock.

Before discussing how to determine the intrinsic value of stock and whether its under or over valued lets first review what a stock isit is not a piece of paper nor is it a. How to calculate intrinsic value. There are several ways to evaluate a stocks true value.

You might come to the table with some preconceived notions of what makes a stock a good value. How to find true value in stocks cheap means different things to different people. By looking deeper into a stocks fundamentals you can determine a more accurate value than the.

A quick way to estimate the range of a stock for value investors using growth numbers.

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Gordon Growth Model Stable Multi Stage Valuation Model

Gordon Growth Model Stable Multi Stage Valuation Model

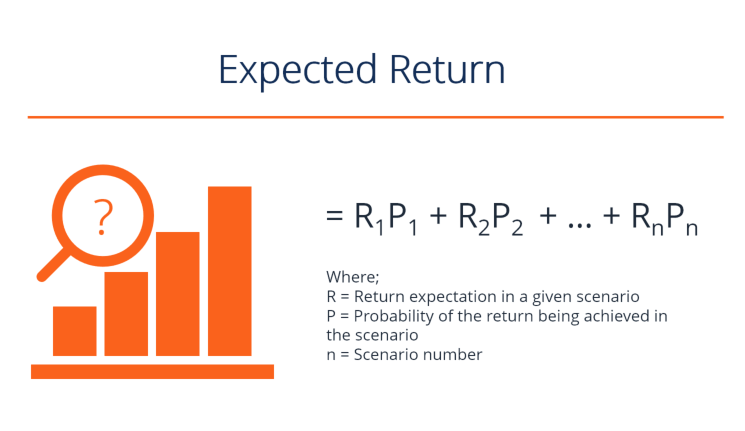

Expected Return How To Calculate A Portfolio S Expected Return

Expected Return How To Calculate A Portfolio S Expected Return

3 Ways To Calculate The Market Value Of A Company Wikihow

3 Ways To Calculate The Market Value Of A Company Wikihow

Methods Of Valuation Of Shares 5 Methods

Understanding How Options Are Priced

Discover The Importance Of Stock Market Business Stats P E

Discover The Importance Of Stock Market Business Stats P E

Best Stocks 31 Stock To Buy For Long Term In India 2020

Best Stocks 31 Stock To Buy For Long Term In India 2020

/ATR1-5a171ba20d327a003786731b.jpg) How Average True Range Atr Can Improve Your Trading

How Average True Range Atr Can Improve Your Trading

Solved 4 Constant Growth Stocks Sci Just Paid A Dividend

Solved 4 Constant Growth Stocks Sci Just Paid A Dividend