How To Use Macd In Forex Trading

Signal line crossovers overboughtoversold levels centerline crossovers as well as divergences. All in all the market is bullish when the macd is above 0 and bearish when its below 0.

How To Use The Macd Indicator Babypips Com

How To Use The Macd Indicator Babypips Com

how to use macd in forex trading

how to use macd in forex trading is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to use macd in forex trading content depends on the source site. We hope you do not use it for commercial purposes.

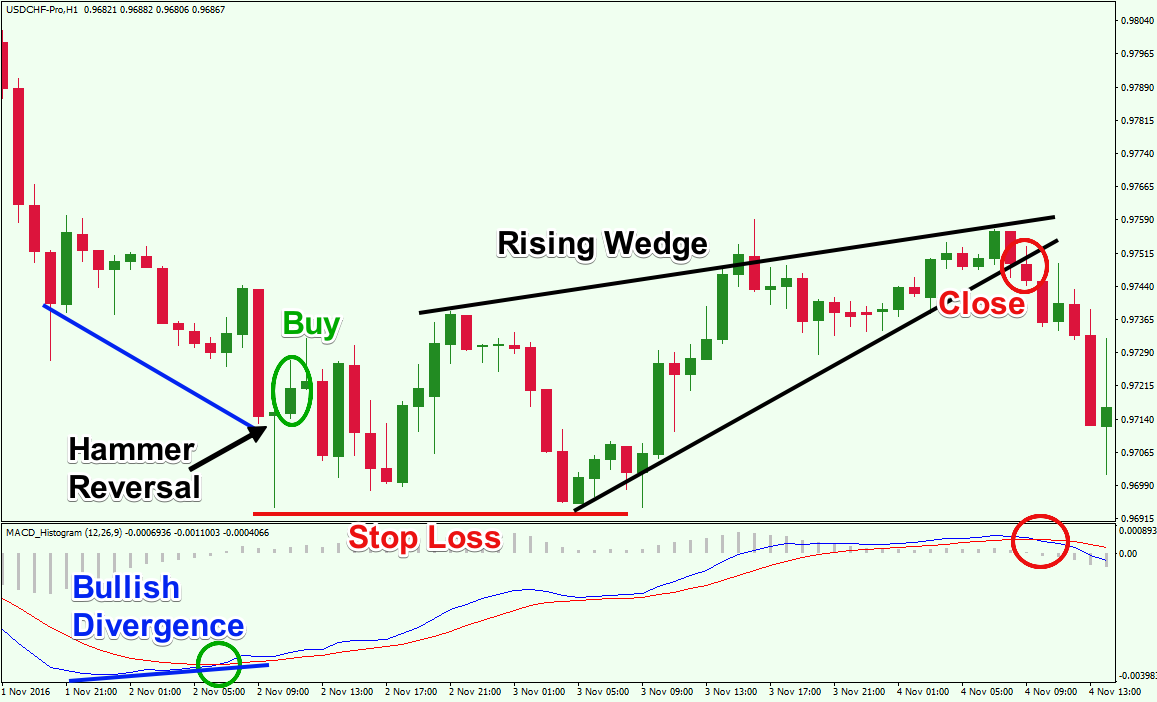

Taking profit a position not starting a short.

How to use macd in forex trading. This week by popular demand david decided to cover the moving average convergence divergence indicator more commonly known as macd. The main indicator is the price. It is also good for confirmation of the reversal signals.

They just wait for a fresh macd movement for a few bars and then they enter. Macd is really good for trend trading. Although many traders are not familiar with this you should know that the macd trading indicator also gives signals that the forex pair is overbought or oversold.

It uses double macd with custom setting to enter trades. Macd is an acronym for moving average convergence divergence. How to use macd to trade forex.

Macd is a technical analysis indicator created by mr gerald appel in the late 1970s. Learn 5 macd trading strategies you can implement in under 1 hour that can help you make money. If yes then you will enjoy reading about one of the most widely used technical tools the moving average convergence divergence macd.

Macd has to be used as a confirmation only. This is a strategy that was used in a forex competition and beat down the competitor. After all our top priority in trading is being able to find a trend because that is where the most money is made.

Trading divergence is a popular way to use the macd histogram which we explain below but unfortunately the divergence trade is not very accurate as it fails more than it succeeds. Macd trading is so common among the forex traders. This tool is used to identify moving averages that are indicating a new trend whether its bullish or bearish.

How to use macd in forex trading. There are five different strategies included in this. The macd provides traders with several types of signals.

What is macd indicator. Bottom line the bullish macd trade you just saw generated 16 pips which equals to 011 profit for my account. Its one of the oscillators that are quite popular with.

Today we will cover 5 trading strategies using. To use as a trading signal macd signal should be treated as a sell to close signal ie.

How To Use The Macd Indicator Babypips Com

How To Use The Macd Indicator Babypips Com

Macd And Its Power In Forex Trading With Pictures

Macd And Its Power In Forex Trading With Pictures

A Quicker Trade Signal Using Macd S Histogram

A Quicker Trade Signal Using Macd S Histogram

:max_bytes(150000):strip_icc()/Figure2-5c425aecc9e77c0001bc2f4f.png) Moving Average Convergence Divergence Macd Definition

Moving Average Convergence Divergence Macd Definition

Forex Trading Strategy Of Macd With Alligator Indicator

Trading With Macd Simple Effective Strategies Explained

Trading With Macd Simple Effective Strategies Explained

Understanding Macd In Forex Trading Mr Forex Medium

Understanding Macd In Forex Trading Mr Forex Medium

21 Ema Macd Scalping Forex Trading Strategy